The yield of annuity can be calculated in similar ways to the yield for a single payment, but two methods are most common.

The first is the standard percentage-change method. Just as for a single payment, this method calculated the percentage difference between the FV and the PV. Since annuities include multiple payments over the lifetime of the investment, the PV (or V1 in is the present value of the entire investment, not just the first payment.

The second popular method is called the internal rate of return (IRR). The IRR is the interest rate (or discount rate) that causes the Net Present Value (NPV) of the annuity to equal 0. That means that the PV of the cash outflows equals the PV of the cash inflows. The higher the IRR, the more desirable is the investment. In theory, you should make investment with an IRR greater than the cost of capital.

Let's take an example investment: It is not technically an annuity because the payments vary, but still is a good example for how to find IRR:

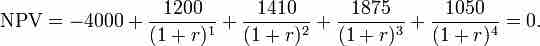

Suppose you have a potential investment that would require you to make a $4,000 investment today, but would return cash flows of $1,200, $1,410, $1,875, and $1,050 in the four successive years. This investment has an implicit rate of return, but you don't know what it is. You plug the numbers into the NPV formula and set NPV equal to 0. You then solve for r, which is your IRR (it's not easy to solve this problem by hand. You will likely need to use a business calculator or Excel). When r = 14.3%, NPV = 0, so therefore the IRR of the investment is 14.3%.

IRR Example

The setup to find the IRR of the investment with cash flows of -4000, 1200, 1410, 1875, and 1050. By setting NPV = 0 and solving for r, you can find the IRR of this investment.