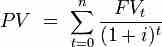

The PV of multiple cash flows follows the same logic as the FV of multiple cash flows. The PV of multiple cash flows is simply the sum of the present values of each individual cash flow .

Sum FV

The PV of an investment is the sum of the present values of all its payments.

Each cash flow must be discounted to the same point in time. For example, you cannot sum the PV of two loans at the beginning of the loans if one starts in 2012 and one starts in 2014. If you want to find the PV in 2012, you need to discount the second loan an additional two years, even though it doesn't start until 2014.

The calculations get markedly simpler if the cash flows make up an annuity. In order to be an annuity (and use the formulas explained in the annuity module), the cash flows need to have three traits:

Things may get slightly messy if there are multiple annuities, and you need to discount them to a date before the beginning of the payments.

Suppose there are two sets of cash flows which you determine are both annuities. The first extends from 1/1/14 to 1/1/16, and the second extends from 1/1/15 to 1/1/17. You want to find the total PV of all the cash flows on 1/1/13.

The annuity formulas are good for determining the PV at the date of the inception of the annuity. That means that it's not enough to simply plug in the payment size, interest rate, and number of periods between 1/1/13 and the end of the annuities. If you do, that supposes that both annuities begin on 1/1/13, but neither do. Instead, you have to first find the PV of the first annuity on 1/1/14 and the second on 1/1/15 because that's when the annuities begin.

You now have two present values, but both are still in the future. You then can discount those present values as if they were single sums to 1/1/13.

Unfortunately, if the cash flows do not fit the characteristics of an annuity, there isn't a simple way to find the PV of multiple cash flows: each cash flow much be discounted and then all of the PVs must be summed together.

Example

A corporation must decide whether to introduce a new product line. The new product will have start-up expenditures, operational expenditures, and then it will have associated incoming cash receipts (sales) and disbursements (Cash paid for materials, supplies, direct labor, maintenance, repairs, and direct overhead) over 12 years. This project will have an immediate (t=0) cash outflow of 100,000 (which might include all cash paid for the machinery, transportation-in and set-up expenditures, and initial employee training disbursements. ) The annual net cash flow (receipts less disbursements) from this new line for years 1-12 is forecast as follows: -54672, -39161, 3054, 7128, 25927, 28838, 46088, 77076, 46726, 76852, 132332, 166047, reflecting two years of running deficits as experience and sales are built up, with net cash receipts forecast positive after that. At the end of the 12 years it's estimated that the entire line becomes obsolete and its scrap value just covers all the removal and disposal expenditures. All values are after-tax, and the required rate of return is given to be 10%. (This also makes the simplifying assumption that the net cash received or paid is lumped into a single transaction occurring on the last day of each year. )

The present value (PV) can be calculated for each year:

T=0:

T=1:

T=2:

T=3:

T=4:

T=5:

T=6:

T=7:

T=8:

T=9:

T=10:

T=11:

T=12:

The sum of all these present values is the net present value, which equals 65,816.04. Since the NPV is greater than zero, it would be better to invest in the project than to do nothing, and the corporation should invest in this project if there is no alternative with a higher NPV.