Working capital is the amount of capital which is readily available to an organization. That is, working capital is the difference between resources in cash or readily convertible into cash (current assets), and cash requirements (current liabilities). As a result, the decisions relating to working capital are always current (i.e., short-term decisions). In addition to the time horizon, working capital decisions differ from capital investment decisions in terms of discounting and profitability considerations; they are also "reversible" to some extent.

Working capital management decisions are, therefore, not made on the same basis as long-term decisions, and working capital management applies different criteria in decision making: the main considerations are (1) cash flow/liquidity and (2) profitability/ return on capital (of which cash flow is generally the most important).

1. Cash Conversion Cycle (CCC)

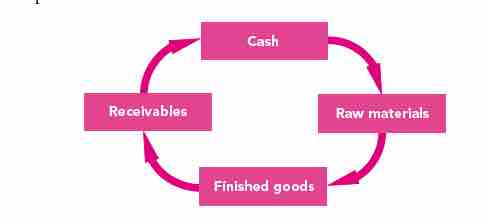

One measure of cash flow is provided by the cash conversion cycle—the net number of days from the outlay of cash for raw material to receiving payment from the customer. As a management tool, this metric makes explicit the interrelatedness of decisions regarding inventories, accounts receivable and payable, and cash. Because this number effectively corresponds to the time that the firm's cash is tied up in operations and unavailable for other activities, management generally aims at a low net count.

Cash cycle

Cash conversion cycle is a main criteria for working capital management.

2. Return On Capital (ROC)

In this context, the most useful measure of profitability is return on capital (ROC). The result is shown as a percentage, determined by dividing relevant income for the 12 months by capital employed; return on equity (ROE) shows this result for the firm's shareholders. Firm value is enhanced when, and if, the return on capital, which results from working-capital management, exceeds the cost of capital, which results from capital investment decisions as above. ROC measures are, therefore, useful as a management tool, in that they link short-term policy with long-term decision making.

Credit policy

Another factor affecting working capital management is credit policy of the firm. It includes buying of raw materials and selling of finished goods either in cash or on credit. This affects the cash conversion cycle.