Refunding occurs when an entity that has issued callable bonds calls those debt securities from the debt holders with the express purpose of reissuing new debt at a lower coupon rate. In essence, the issue of new, lower-interest debt allows the company to prematurely refund the older, higher-interest debt. On the contrary, nonrefundable bonds may be callable, but they cannot be re-issued with a lower coupon rate (i.e., they cannot be refunded).

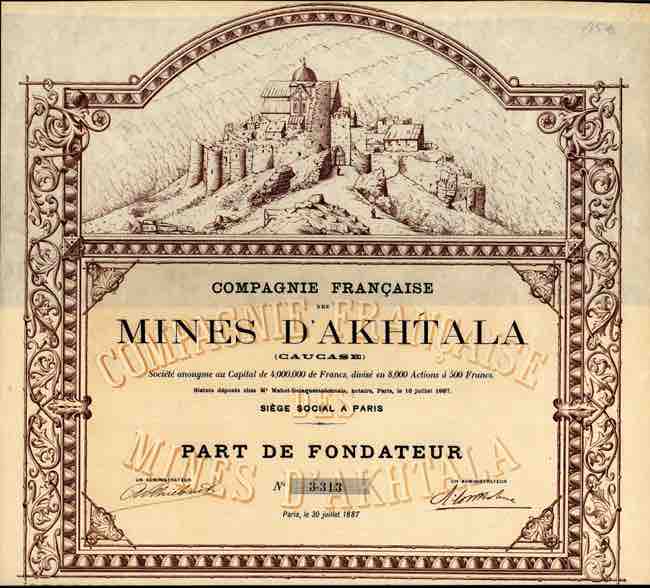

French Bond

French Bond for the Akhtala mines issued in 1887.

The decision of whether to refund a particular debt issue is usually based on a capital budgeting (present value) analysis. The principal benefit, or cash inflow, is the present value of the after-tax interest savings over the life of the issue.

Bond refunding occurs when all three of the following are true

- Interest rates in the market are sufficiently less than the coupon rate on the old bond

- The price of the old bond is less than par

- The sinking fund has accumulated enough money to retire the bond issue.

The three steps of whether to make a refunding decision are as follows:

Step 1: Calculate the present value of interest savings (cash inflows):

Interest savings = annual interest of old issue - annual interest of new issue

Step 2: Calculate the net investment (net cash outflow at time 0). This involves computing the after-tax call premium, the issuance cost of the new issue, the issuance cost of the old issue, and the overlapping interest. The call premium is a cash outflow.

Step 3: Finally, calculate the net present value of refunding.

Net present value of refunding = Present value of interest savings - Present value of net investment