In addition to using financial ratio analysis to compare one company with others in its peer group, ratio analysis is often used to compare the company's performance on certain measures over time. Trend analysis is the practice of collecting information and attempting to spot a pattern, or trend, in the information. This often involves comparing the same metric historically, either by examining it in tables or charts. Often this trend analysis is used to forecast or inform decisions around future events, but it can be used to estimate uncertain events in the past .

Trend Analysis

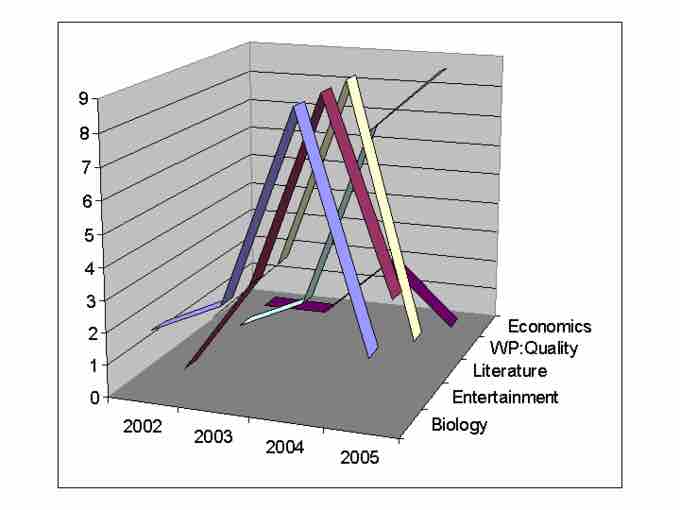

Determining the popularity and demand for specific subject over time through trend analysis.

Trend analysis can be performed in different ways in finance. For example, in technical analysis the direction of prices of a particular company's public stock is calculated through the study of past market data, primarily price, and volume. Fundamental analysis, on the other hand, relies not on sentiment measures (like technical analysis) but on financial statement analysis, often in the form of ratio analysis. Creditors and company managers also use ratio analysis as a form of trend analysis. For example, they may examine trends in liquidity or profitability over time.

Trend analysis using financial ratios can be complicated by the fact that companies and accounting can change over time. For example, a company may change its business model so that it begins to operate in a new industry or it may change the end of its financial year or the way it accounts for inventories. When examining historical trends in ratios, analysts will often make adjustments to the ratios for these reasons, perhaps performing some ratio analysis in which they segment out business segments that are not consistent over time or they separate recurring from non-recurring items.