Extraordinary Gains and Losses

Extraordinary items are both unusual (abnormal) and infrequent, for example, unexpected natural disaster, expropriation, prohibitions under new regulations. It is notable that a natural disaster might not qualify depending on location (e.g., frost damage would not qualify in Canada but would in the tropics).

Extra gains or losses are the result of unforeseen and atypical events. They are nonrecurring, onetime, unusual, non-operating gains, or losses that are recorded by a business during the period.

No items may be presented in the income statement as extraordinary items under IFRS regulations, but are permissible under US GAAP. (IAS 1.87) The amount of each of these gains or losses, net of the income tax effect, is reported separately in the income statement. Net income is reported before and after these gains and losses. As a result, extraordinary gains or losses don't skew the company's regular earnings. These gains and losses should not be recorded very often but, in fact, many businesses record them every other year or so, causing much consternation to investors. In addition to evaluating the regular stream of sales and expenses that produce operating profit, investors also have to factor into their profit performance analysis the perturbations of these irregular gains and losses reported by a business.

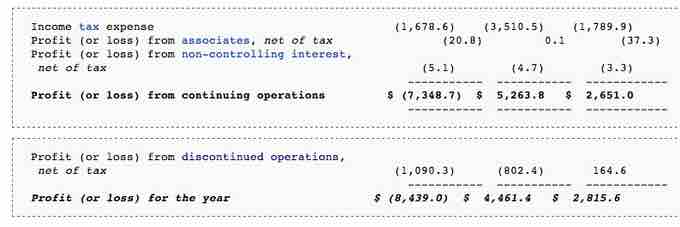

Income statement in accordance with IFRS

This income statement is a very brief example prepared in accordance with IFRS; no extraordinary items are presented.

Examples of extraordinary items are casualty losses, losses from expropriation of assets by a foreign government, gain on life insurance, gain or loss on the early extinguishment of debt, gain on troubled debt restructuring, and write-off of an intangible asset. Write down and write off of receivables and inventory are not extraordinary, because they relate to normal business operational activities.They would be considered extraordinary, however, if they resulted from an Act of God (e.g., casualty loss arising from an earthquake) or governmental expropriation.