Monetary policy is the process by which the monetary authority of a country, which could be a government agency or a central bank, controls the supply of money, often targeting a rate of interest for the purpose of promoting economic growth and stability. The official goals usually include relatively stable prices and low unemployment.

Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by easing credit to entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values, or to cool an overheating economy. Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.

Expansionary Monetary Policy

A monetary authority will typically pursue expansionary monetary policy when there is an output gap - that is, a country is producing output at a lower level than its potential output. Without a policy intervention the output gap may correct itself, if falling wages and prices shift the short-run aggregate supply curve to the right until the economy returns to the long-run equilibrium. Alternatively, the monetary authority could intervene in order to increase aggregate demand and close the output gap. Expansionary monetary policy consists of the tools that a central bank uses to achieve this increase in aggregate demand.

In practice, this means that a monetary authority will use the tools at its disposal in order to increase the money supply and decrease interest rates. Since interest rates represent the price of money, lower interest rates will cause the quantity of money demanded to increase, stimulating investment and spending. In addition, lower interest rates make a currency worth less in the currency exchange market. This reduces the demand for and increases the supply of dollars in the currency market, reducing the exchange rate (in foreign currency per dollar). A lower exchange rate makes a country's goods relatively more affordable for the rest of the world, stimulating exports and further increasing output.

Contractionary Monetary Policy

By contrast, a monetary authority will pursue a contractionary monetary policy when it considers inflation a threat. Suppose, for example, that high short-run aggregate demand creates an equilibrium in which prices are higher than in the long-run equilibrium. This will cause high levels of inflation. In response, the monetary authority may reduce the money supply and thereby raise the interest rate. Investment falls as the interest rate rises. The higher interest rate also increases the demand for dollars as foreign investors shift their investments to the United States. Likewise, the supply of dollars declines. Consumers in the United States purchase domestic interest-bearing assets rather than purchasing assets abroad, taking advantage of the higher domestic interest rate. Increased demand and decreased supply cause an increase in the exchange rate, which boots imports while reducing exports. Thus, contractionary monetary policy causes aggregate demand to fall, thereby reducing the rate of inflation. .

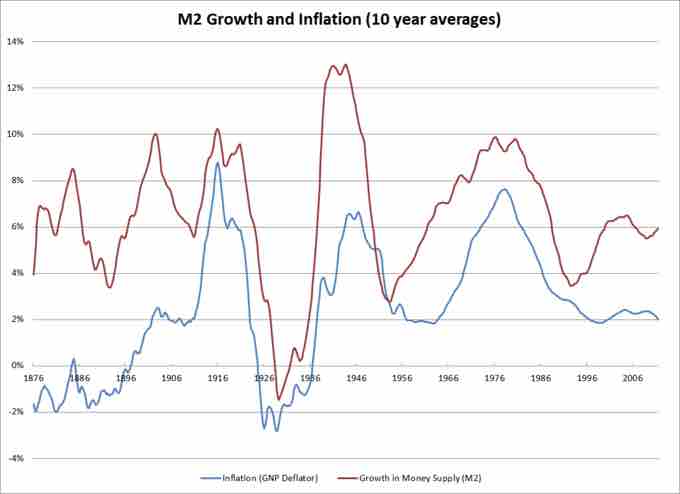

Money Supply and Inflation

The graph shows the relationship between the money supply and the inflation rate. By controlling the money supply, monetary authorities hope to influence the rate of inflation.