The demand curve of a monopolistic competitive market slopes downward. This means that as price decreases, the quantity demanded for that good increases. While this appears to be relatively straightforward, the shape of the demand curve has several important implications for firms in a monopolistic competitive market.

Monopolistic Competition

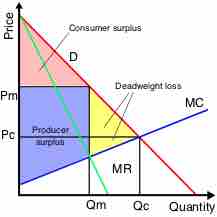

As you can see from this chart, the demand curve (marked in red) slopes downward, signifying elastic demand.

Market Power

The demand curve for an individual firm is downward sloping in monopolistic competition, in contrast to perfect competition where the firm's individual demand curve is perfectly elastic. This is due to the fact that firms have market power: they can raise prices without losing all of their customers. In this type of market, these firms have a limited ability to dictate the price of its products; a firm is a price setter not a price taker (at least to some degree). The source of the market power is that there are comparatively fewer competitors than in a competitive market, so businesses focus on product differentiation, or differences unrelated to price. By differentiating its products, firms in a monopolistically competitive market ensure that its products are imperfect substitutes for each other. As a result, a business that works on its branding can increase its prices without risking its consumer base.

Inefficiency in the Market

Monopolistically competitive firms maximize their profit when they produce at a level where its marginal costs equals its marginal revenues. Because the individual firm's demand curve is downward sloping, reflecting market power, the price these firms will charge will exceed their marginal costs. Due to how products are priced in this market, consumer surplus decreases below the pareto optimal levels you would find in a perfectly competitive market, at least in the short run. As a result, the market will suffer deadweight loss. The suppliers in this market will also have excess production capacity.