The short-run Phillips curve is said to shift because of workers' future inflation expectations. Yet, how are those expectations formed? There are two theories that explain how individuals predict future events.

Real versus Nominal Quantities

To fully appreciate theories of expectations, it is helpful to review the difference between real and nominal concepts. Anything that is nominal is a stated aspect. In contrast, anything that is real has been adjusted for inflation. To make the distinction clearer, consider this example. Suppose you are opening a savings account at a bank that promises a 5% interest rate. This is the nominal, or stated, interest rate. However, suppose inflation is at 3%. The real interest rate would only be 2% (the nominal 5% minus 3% to adjust for inflation).

The difference between real and nominal extends beyond interest rates. In an earlier atom, the difference between real GDP and nominal GDP was discussed. The distinction also applies to wages, income, and exchange rates, among other values.

Adaptive Expectations

The theory of adaptive expectations states that individuals will form future expectations based on past events. For example, if inflation was lower than expected in the past, individuals will change their expectations and anticipate future inflation to be lower than expected.

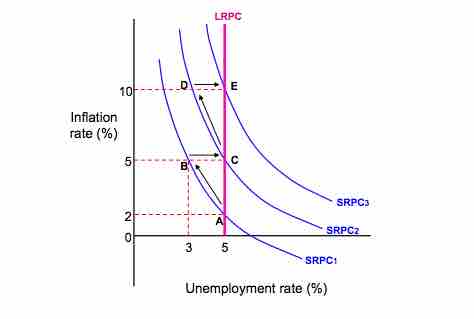

To connect this to the Phillips curve, consider . Assume the economy starts at point A at the natural rate of unemployment with an initial inflation rate of 2%, which has been constant for the past few years. Accordingly, because of the adaptive expectations theory, workers will expect the 2% inflation rate to continue, so they will incorporate this expected increase into future labor bargaining agreements. This way, their nominal wages will keep up with inflation, and their real wages will stay the same.

Expectations and the Phillips Curve

According to adaptive expectations theory, policies designed to lower unemployment will move the economy from point A through point B, a transition period when unemployment is temporarily lowered at the cost of higher inflation. However, eventually, the economy will move back to the natural rate of unemployment at point C, which produces a net effect of only increasing the inflation rate.According to rational expectations theory, policies designed to lower unemployment will move the economy directly from point A to point C. The transition at point B does not exist as workers are able to anticipate increased inflation and adjust their wage demands accordingly.

Now assume that the government wants to lower the unemployment rate. To do so, it engages in expansionary economic activities and increases aggregate demand. As aggregate demand increases, inflation increases. Because of the higher inflation, the real wages workers receive have decreased. For example, assume each worker receives $100, plus the 2% inflation adjustment. Each worker will make $102 in nominal wages, but $100 in real wages. Now, if the inflation level has risen to 6%. Workers will make $102 in nominal wages, but this is only $96.23 in real wages.

Although the workers' real purchasing power declines, employers are now able to hire labor for a cheaper real cost. Consequently, employers hire more workers to produce more output, lowering the unemployment rate and increasing real GDP. On , the economy moves from point A to point B.

However, workers eventually realize that inflation has grown faster than expected, their nominal wages have not kept pace, and their real wages have been diminished. They demand a 4% increase in wages to increase their real purchasing power to previous levels, which raises labor costs for employers. As labor costs increase, profits decrease, and some workers are let go, increasing the unemployment rate. Graphically, the economy moves from point B to point C.

This example highlights how the theory of adaptive expectations predicts that there are no long-run trade-offs between unemployment and inflation. In the short run, it is possible to lower unemployment at the cost of higher inflation, but, eventually, worker expectations will catch up, and the economy will correct itself to the natural rate of unemployment with higher inflation.

Rational Expectations

The theory of rational expectations states that individuals will form future expectations based on all available information, with the result that future predictions will be very close to the market equilibrium. For example, assume that inflation was lower than expected in the past. Individuals will take this past information and current information, such as the current inflation rate and current economic policies, to predict future inflation rates.

As an example of how this applies to the Phillips curve, consider again. Assume the economy starts at point A, with an initial inflation rate of 2% and the natural rate of unemployment. However, under rational expectations theory, workers are intelligent and fully aware of past and present economic variables and change their expectations accordingly. They will be able to anticipate increases in aggregate demand and the accompanying increases in inflation. As such, they will raise their nominal wage demands to match the forecasted inflation, and they will not have an adjustment period when their real wages are lower than their nominal wages. Graphically, they will move seamlessly from point A to point C, without transitioning to point B.

In essence, rational expectations theory predicts that attempts to change the unemployment rate will be automatically undermined by rational workers. They can act rationally to protect their interests, which cancels out the intended economic policy effects. Efforts to lower unemployment only raise inflation.