While fiscal policy can be a powerful tool for influencing the economy, there are limits in how effective these policies are.

Coordination with Monetary Policy

Fiscal policy and monetary policy are the two primary tools used by the State to achieve its macroeconomic objectives. While the main objective of fiscal policy is to influence the aggregate output of the economy, the main objective of the monetary policies is to control the interest and inflation rates. Fiscal policies have an impact on the goods market and monetary policies have an impact on the asset markets and since the two markets are connected to each other via the two macrovariables — output and interest rates - the policies interact while influencing the output or the interest rates.

There is controversy regarding whether these two policies are complementary or act as substitutes to each other for achieving macroeconomic goals. Policy makers are viewed to interact as strategic substitutes when one policy maker's expansionary (contractionary) policies are countered by another policy maker's contractionary (expansionary) policies. For example: if the fiscal authority raises taxes or cuts spending, then the monetary authority reacts to it by lowering the policy rates and vice versa. If they behave as strategic complements,then an expansionary (contractionary) policy of one authority is met by expansionary (contractionary) policies of other.

The issue of interaction and the policies being complement or substitute to each other arises only when the authorities are independent of each other. But when, the goals of one authority is made subservient to that of others, then the dominant authority solely dominates the policy making and no interaction worthy of analysis would arise. Also, it is worthy to note that fiscal and monetary policies interact only to the extent of influencing the final objective. So long as the objectives of one policy is not influenced by the other, there is no direct interaction between them.

Political Conflict

Fiscal policy is also a source of significant political conflict along party lines. Conservatives are more likely to reject Keynesianism and are more likely to argue that government should always run a balanced budget (and a surplus to pay down any outstanding debt), and that deficit spending is always bad policy .

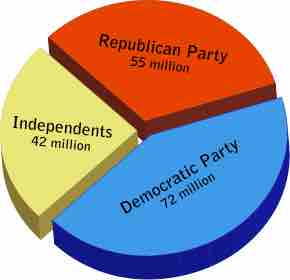

American political divide

There are two different approaches to fiscal policy in the US. Broadly, Democrats tend to be more Keynesian than Republicans.

Fiscal conservatism has academic support, predominantly associated with the neoclassical-inclined Chicago school of economics, and has significant political and institutional support, with all but one state of the United States (Vermont is the exception) having a balanced budget amendment to its state constitution. Fiscal conservatism was the dominant position until the Great Depression.

Liberals are more likely to be Keynesian and Post-Keynesians than Republican. They are more likely to argue that deficit spending is necessary, either to create the money supply (Chartalism) or to satisfy demand for savings in excess of what can be satisfied by private investment.

Chartalists argue that deficit spending is logically necessary because, in their view, fiat money is created by deficit spending: one cannot collect fiat money in taxes before one has issued it and spent it, and the amount of fiat money in circulation is exactly the government debt – money spent but not collected in taxes.

Fiscal Multiplier

The fiscal multiplier is the ratio of a change in national income to the change in government spending that causes it. When this multiplier exceeds one, the enhanced effect on national income is called the multiplier effect. The mechanism that can give rise to a multiplier effect is that an initial incremental amount of spending can lead to increased consumption spending, increasing income further and hence further increasing consumption, etc., resulting in an overall increase in national income greater than the initial incremental amount of spending. In other words, an initial change in aggregate demand may cause a change in aggregate output that is a multiple of the initial change.

How effective fiscal policy is depends on the multiplier. The greater the multiplier, the more effective the policy. If for some reason outside of the control of the government the multiplier remains low, the effectiveness of fiscal policy will remain limited at best.