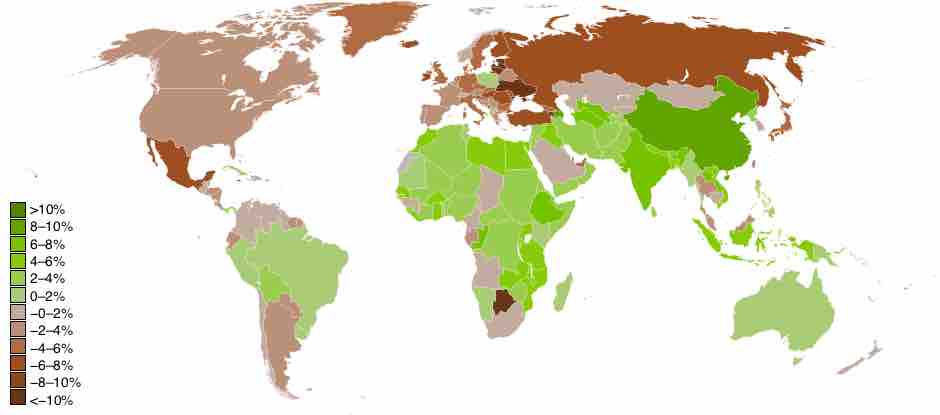

Modern markets are dependent upon one another across national borders, where global trends in economic growth and well-being will have a dramatic impact on national economic well-being and vice versa. As a result, the 2007-2009 economic collapse had large effects not only at the origin (in the United States), but also on a global scale. The speed in which the market decline spread across the globe underlines just how far globalization and international interdependence has come, with GDP growth numbers in 2009 already demonstrating substantial losses across the map (see ).

2009 Global GDP Growth and Decline)

As this map illustrates, many international markets fell rapidly into decline as a direct result of the U.S. sub-prime mortgage disaster.

Recession: Domestic to Global

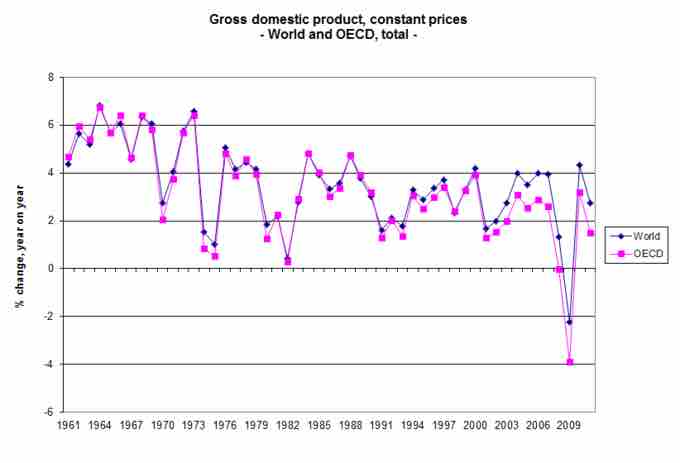

In December 2007, the U.S. officially fell into an 18-month long recessionary period of negative GDP growth (over two consecutive quarters). This recessionary period spread rapidly around the map, creating a global recession in Q3 and Q4 in 2008 and Q1 of 2009 (defined as a contraction in global GDP growth during that time) as is represented in this figure . To provide additional context to the global adverse effects of the sub-prime mortgage crisis, of 65 countries that record and report GDP only 11 escaped a recessionary period between 2006 and today.

World GDP Growth

It is quite clear in this graphic, the global GDP growth dropped dramatically following the U.S. crisis, pitching the entire global economy into a recession.

Even countries where double-digit economic growth had been a consistent trend going into 2008, such as China, began to experience growth reductions due to reduced consumer purchasing power on a global scale. China has seen reductions towards the 7%-8% economic GDP growth (year on year), from clear double-digits in previous years.

Political Instability

Another indirect global impact that occurred as a result of the economic collapse is political instability, primarily due to the inability of developed nations to pursue social welfare investments and global poverty reduction processes during recessionary times. Indeed, these instabilities are not only isolated to developing nations. Countries in the EU, such as Greece, Spain and Italy, have seen dramatic GDP decreases and unemployment numbers reaching or exceeding 20% in some cases. This instability has placed a great deal of pressure on government officials to solve these huge economic problems in the short-term. The United States has also seen an incredible reduction in governmental efficacy with the least effective house of representatives for nearly a century alongside dramatic polarization of public opinion towards left-wing and right-wing ideas.

Global Responses

Positively, many global organizations and countries are actively employing policies to minimize the likelihood of a re-occurrence in the future. Reducing interest rates to drive up borrowing and investment, providing tax benefits to the unemployed and underemployed, and subsidizing new business have created positive steps towards meaningful recovery globally.

There have also been a series of banking and financial regulatory changes across the world.These global safety nets and prevention policies are setting the tone for future strategies to avoid economic crises and minimize the prospective damage that occurs as a result of these unethical practices.