The recent financial crisis, commonly referred to as the sub-prime mortgage crisis of 2007-2008, was borne of the failure of a series of derivative-based consolidation of mortgage-backed securities that encapsulated extremely high risk loans to homeowners into a falsely 'safe' investment. To simplify this, banks pushed mortgages on prospective home owners who could not afford to repay them. Then they combined and packaged varying mortgage-backed securities based off of these loans and sold them as highly dependable and safe investments, either through a lack of due diligence (negligence) or lack of ethical consideration. This created an economic meltdown, starting with the United States, that spread across the global markets.

The inherent complexity of the causes and dramatic repercussions (most of which are still ongoing) require a great deal of context. It is a fiercely debated and widely discussed issue in the field of economics (and in mainstream media), providing a real-life case study for many of the critical concepts of economic theory.

How Did This Happen?

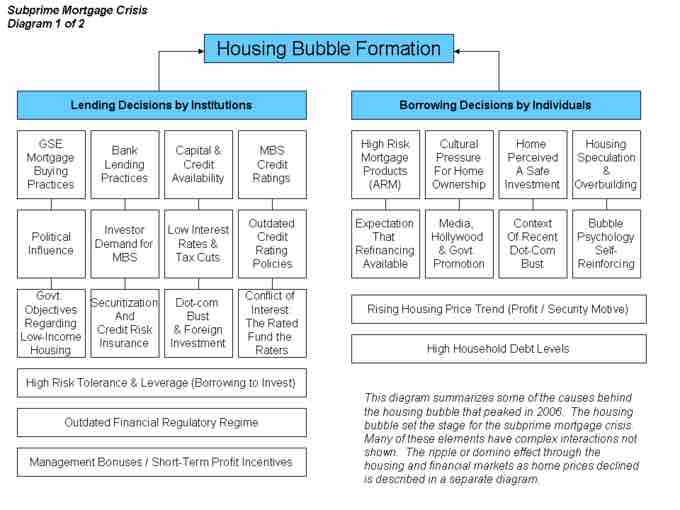

The inputs to the 2007-2008 economic collapse, briefly touched upon above, are complex and still evolving. That being said, there are a few key talking points from an economic perspective that should be discussed. A useful perspective to take is the various stakeholders and their contributions :

Inputs to the Mortgage Crisis

This graph outlines two of the three parties in the collapse (excludes government), as the banks and the buyers both took on ridiculous amounts of risk.

- Banks: Simply put, the banks made two critical errors. First, they lent money to people who could not pay it back (to buy homes). They pursued what is referred to as 'predatory lending,' or lending to individuals they knew could never pay it back. Secondly, banks knowingly grouped these loans into bundles called collateralized debt obligations (CDOs) and sold them as extremely safe derivative investments. They were not safe.

- Consumers: Consumers played their role as well, acting as easy prey for the banks predatory practices. Individuals bought homes they could not afford utilizing loans they could not pay back. This drove them into debt, to the extent at which they had to default. This meant that the capital banks expected to get back did not arrive, it simply was not there.

- Government: The government did not regulate the housing market, as a result of the elimination of two critical legal clauses that required the verification of income and a 20% down payment. In short, the U.S. government used to ensure that prospective home buyers could put down 20% of the their borrowing in addition to verify that their income could cover their mortgage payments. Without such verification, it became easier for people to get mortgages they could not afford.

Combining these factors, the problem largely revolved around irresponsible lending and borrowing which was then turned into derivatives that were labeled safe despite their massive risks. This resulted in an economic realization of loans that could not be repaid, which spread through the banking system and turned into large scale obligations that could not be met.

Economic Impact

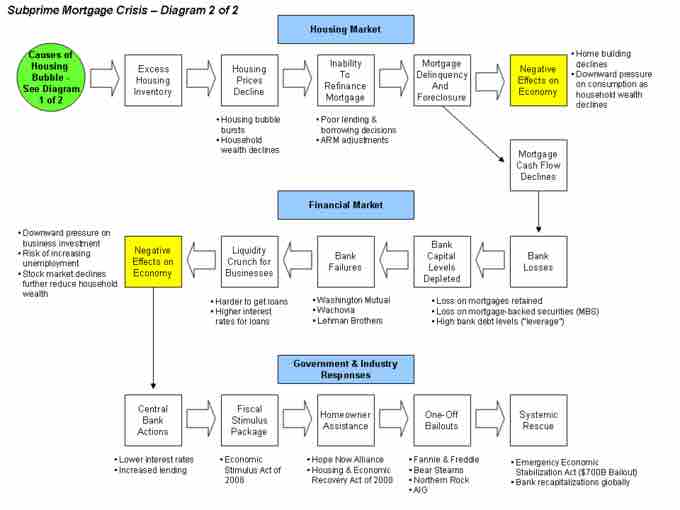

What happened next is well captured in the . In short, the banks eventually failed due to their investments. In order to prevent the entire financial system from collapsing, some of the banks (and other financial institutions) were bailed out.

2008 Crisis Flow Chart

This chart embodies critical checkpoints in the economic decline reactions to poor mortgage management by the banks. Understanding the implications of each point on this diagram will greatly enhance the larger understanding of the short term effects of this economic collapse.

Of course the negative effects did not stop there. The U.S. stock market lost confidence in financial institutions and some of the companies connected to them and subsequently crashed. The NYSE fell by half, drastically reducing the value of the U.S. economy. This was then telegraphed into a loss of consumer confidence and business access to investment. Within a few months, there were job cuts, bankruptcies, and reduced spending, as the crisis spread throughout the economy (both domestically and globally).