Consumer choices are predicated on various economic circumstances, and recognizing the relationship between these circumstances and an individual's purchasing behavior allows economists to recognize and predict consumer choice trends. One of the central considerations for a consumer in deciding upon their purchasing behaviors is their overall income or wage levels, and thus their budgetary constraints. These budgetary constraints, when applied to a series of products and services, can be optimized to capture the most utility for the consumer based on their purchasing power.

Income from a Consumer Theory Perspective

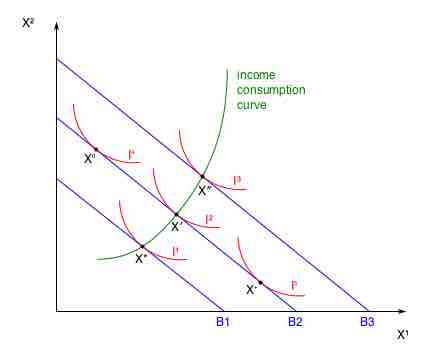

The simplest way to demonstrate the effects of income on overall consumer choice, from the viewpoint of Consumer Theory, is via an income-consumption curve for a normal good(see ). The basic premise behind this curve is that the varying income levels (as illustrated by the green income line curving upwards) will determine different quantities and balanced baskets along the provided indifference curves for the two goods being compared in this graph. These differences in quantity reflect the increase or decrease an a given individual's purchasing power, thus the income effect could be summarized as the increase in relative utility captured by a consumer with more monetary power.

Income-Consumption Curve

Simply put, increases or decreases in income will alter the optimal quantity (and thus relative utility) of a given basket of goods for a specific consumer.

The wealth effect differs slightly from the income effect. The wealth effect reflects changes in consumer choice based on perceived wealth, not actual income. For example, if a person owns a stock that appreciates in price, they perceive that they are wealthier and may spend more, even though they have not realized those gains so their income has not increased.

Effects of Income on Different Goods

Income effects on consumer choice grow more complex as the type of good changes, as different product and services demonstrate different properties relative to both other products/services and a consumers preferences and utility. As a result, it is useful to outline the differences in income effects on normal, inferior, complementary and substitute goods:

- Normal:A normal good is a good with incremental increases or decreases in utility as quantity changes, demonstrating a predictable and simple linear relationship as income increases or decreases. demonstrates a graphical representation of the effects of income changes upon preference map.

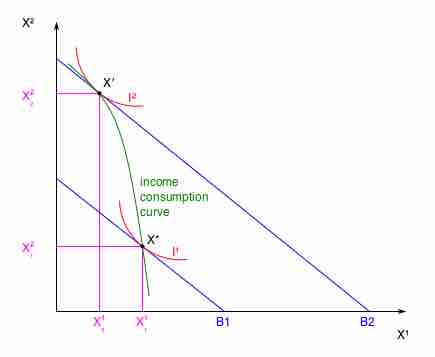

- Inferior:Inferior goods, or goods that are less preferable, will demonstrate inverse relationships with income compared to normal goods. That is to say that an increase in income will not necessarily result in an increase in quantity for the inferior good, as the consumer derives minimal utility in purchasing the inferior good compared to other goods. Inferior goods are often sacrificed as income rises and consumers gain more choice/options. This can be represented in .

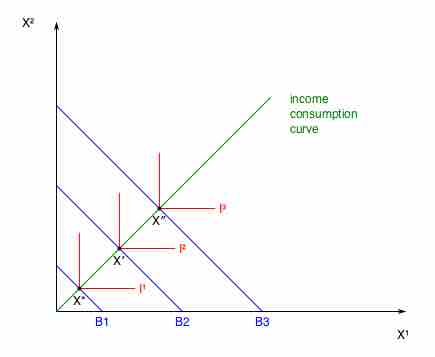

- Complementary: Complementary goods are goods that are interdependent in consumption, or essentially goods that require simultaneous consumption by the consumer. An example of this would be like purchasing an automobile and car insurance, the consumption of one requires the consumption of the other. As income increases, these will increase relative to one another (as a ratio). demonstrates this concept in graphical form.

- Substitutes: Perfect substitutes are essentially interchangeable goods, where the consumption of one compared to another has no meaningful impact on the consumer's utility derived. Substitutes are goods that a consumer cannot differentiate between in terms of the need being filled and the satisfaction obtained. Income increases will thus affect the consumption of these goods interchangeably, resulting in increase in the quantity of either or both.

In merging Consumer Theory and consumer choices with income level, the primary takeaway is that an increase in income will increase the prospective utility that consumer can acquire in the market. Understanding how this applies in a general fashion, alongside the specific circumstances dictating specific types of goods, it becomes fairly straight-forward to predict consumer purchasing behaviors at differing income levels.

Income Levels and Inferior Goods

This graph demonstrates the inverse relationship between income and the consumption of inferior goods. As income rises, the quantity consumed of 'X1' decreases. This illustrates increased variance in consumer choice as income rises.

Income Effect on Complementary Goods

In this graphical depiction of income increases, the consumption of these two goods are complementary and thus interdependent.