The concept of perfect competition applies when there are many producers and consumers in the market and no single company can influence the pricing. A perfectly competitive market has the following characteristics:

- There are many buyers and sellers in the market.

- Each company makes a similar product.

- Buyers and sellers have access to perfect information about price.

- There are no transaction costs.

- There are no barriers to entry into or exit from the market.

All goods in a perfectly competitive market are considered perfect substitutes, and the demand curve is perfectly elastic for each of the small, individual firms that participate in the market. These firms are price takers--if one firm tries to raise its price, there would be no demand for that firm's product. Consumers would buy from another firm at a lower price instead.

Firm Revenues

A firm in a competitive market wants to maximize profits just like any other firm. The profit is the difference between a firm's total revenue and its total cost. For a firm operating in a perfectly competitive market, the revenue is calculated as follows:

- Total Revenue = Price * Quantity

- AR (Average Revenue) = Total Revenue / Quantity

- MR (Marginal Revenue) = Change in Total Revenue / Change in Quantity

The average revenue (AR) is the amount of revenue a firm receives for each unit of output. The marginal revenue (MR) is the change in total revenue from an additional unit of output sold. For all firms in a competitive market, both AR and MR will be equal to the price.

Profit Maximization

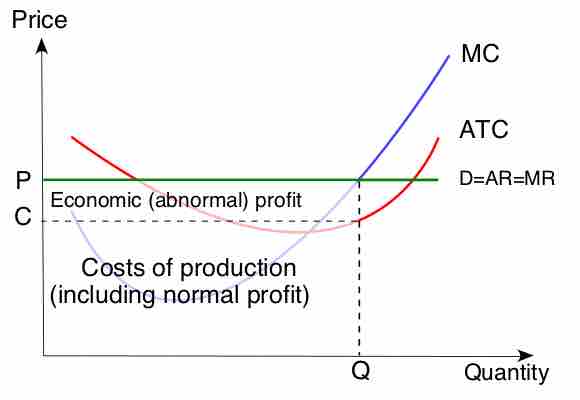

In order to maximize profits in a perfectly competitive market, firms set marginal revenue equal to marginal cost (MR=MC). MR is the slope of the revenue curve, which is also equal to the demand curve (D) and price (P). In the short-term, it is possible for economic profits to be positive, zero, or negative . When price is greater than average total cost, the firm is making a profit. When price is less than average total cost, the firm is making a loss in the market.

Perfect Competition in the Short Run

In the short run, it is possible for an individual firm to make an economic profit. This scenario is shown in this diagram, as the price or average revenue, denoted by P, is above the average cost denoted by C .

Over the long-run, if firms in a perfectly competitive market are earning positive economic profits, more firms will enter the market, which will shift the supply curve to the right. As the supply curve shifts to the right, the equilibrium price will go down. As the price goes down, economic profits will decrease until they become zero.

When price is less than average total cost, firms are making a loss. Over the long-run, if firms in a perfectly competitive market are earning negative economic profits, more firms will leave the market, which will shift the supply curve left. As the supply curve shifts left, the price will go up. As the price goes up, economic profits will increase until they become zero.

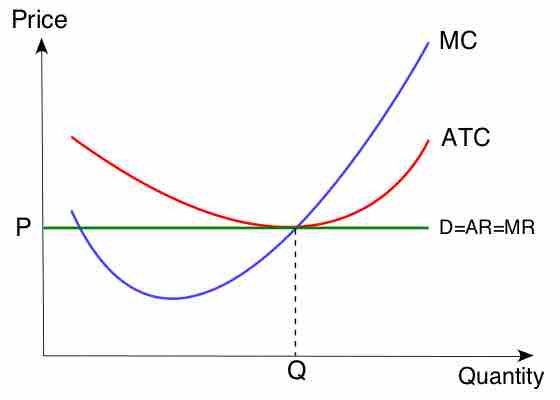

In sum, in the long-run, companies that are engaged in a perfectly competitive market earn zero economic profits . The long-run equilibrium point for a perfectly competitive market occurs where the demand curve (price) intersects the marginal cost (MC) curve and the minimum point of the average cost (AC) curve.

Perfect Competition in the Long Run

In the long-run, economic profit cannot be sustained. The arrival of new firms in the market causes the demand curve of each individual firm to shift downward, bringing down the price, the average revenue and marginal revenue curve. In the long-run, the firm will make zero economic profit. Its horizontal demand curve will touch its average total cost curve at its lowest point.