Net income in accounting is an entity's income minus expenses for an accounting period. It is computed as the residual of all revenues and gains over all expenses and losses for the period and has also been defined as the net increase in stockholder's equity that results from a company's operations. Net income is a distinct accounting concept from profit. Profit is a term that means different things to different people, and different line items in a financial statement may carry the term "profit," such as gross profit and profit before tax. In contrast, net income is a precisely defined term in accounting.

Often, the term income is substituted for net income, yet this is not preferred due to the possible ambiguity. Net income is informally called the "bottom line," because it is typically found on the last line of a company's income statement (a related term is "top line," meaning revenue, which forms the first line of the account statement). The items deducted will typically include tax expense, financing expense (interest expense), and minority interest.Likewise, preferred stock dividends will be subtracted too, though they are not an expense. For a merchandizing company, subtracted costs may be the cost of goods sold, sales discounts, and sales returns and allowances. For a product company advertising, manufacturing, and design and development costs are included.

Net income can be distributed among holders of common stock as a dividend or held by the firm as an addition to retained earnings. As profit and earnings are used synonymously for income (also depending on United Kingdom and U.S. usage), net earnings and net profit are commonly found as synonyms for net income. Often, the term "income" is substituted for net income, yet this is not preferred due to the possible ambiguity.

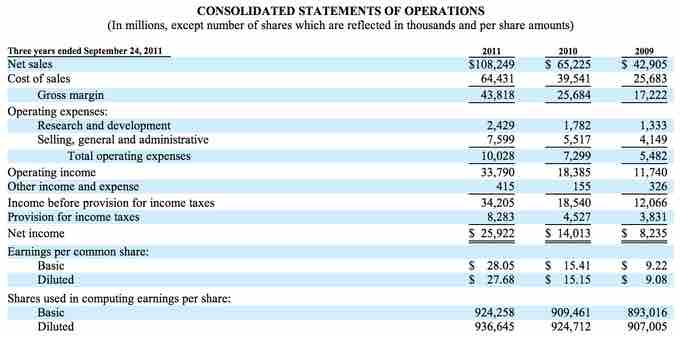

Apple Inc's Income Statement

Apple's revenues and net income rose greatly in 2011.

An equation for net income:

Net sales (revenue) – Cost of goods sold = Gross profit – SG&A expenses (combined costs of operating the company) = EBITDA – Depreciation & amortization = EBIT – Interest expense (cost of borrowing money) = EBT – Tax expense = Net income (EAT)