Use of Credit and Financing for Operations

Business operations can require the use of credit and financing to meet operating needs. Credit, in commerce and finance, is a term used to denote transactions involving the transfer of money or other property on promise of repayment, usually at a fixed future date and at a specific interest rate . The transferor thereby becomes a creditor, and the transferee (the recipient of the funds or property) becomes a debtor. Credit is sometimes not granted to a person or business with financial instability or difficulty. Companies frequently offer credit to their customers as part of the terms of a purchase agreement. Organizations that offer credit to their customers frequently employ a credit manager .

Loans can weigh a business down.

The use of credit is a necessity in business and should be managed wisely.

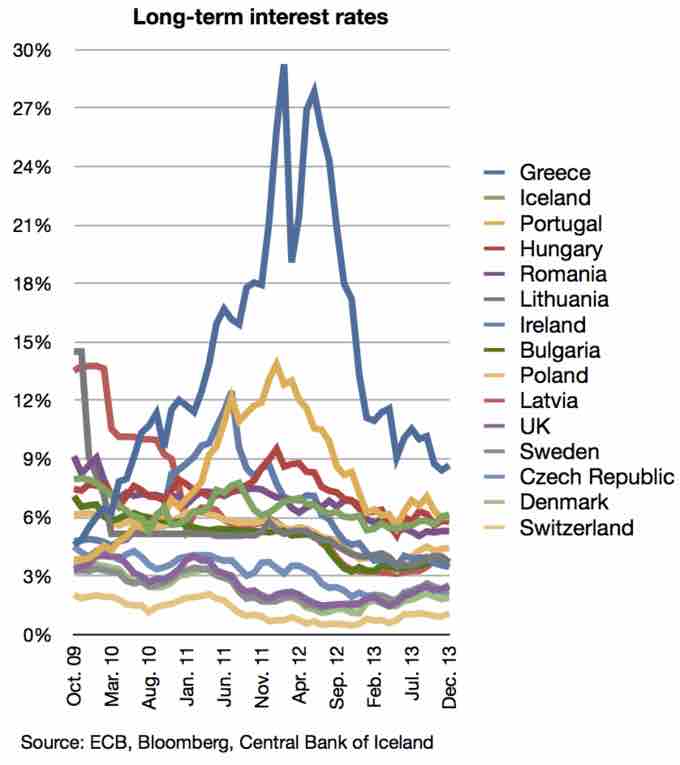

Interest Rates

Long-term interest rate statistics for non-Euro countries plus Greece, Portugal, and Ireland.

Types of Credit

A line of credit is any credit source extended to a business or individual by a bank or other financial institution. A line of credit may take several forms, such as overdraft protection, demand loan, special purpose, export packing credit, term loan, discounting, purchase of commercial bills, traditional revolving credit card account, etc. It is effectively a source of funds that can readily be used at the borrower's discretion. Interest is paid only on money actually withdrawn. Lines of credit can be secured by collateral or may be unsecured.

A revolving credit line provides a borrower with a maximum aggregate amount of capital, available over a specified period of time. However, unlike a term loan, revolving debt allows the borrower to draw down, repa,y and re-draw credit amounts advanced to her by the available capital during the term of the debt. Each credit line is borrowed for a set period of time, usually one, three, or six months, after which time it is technically repayable. Repayment of revolving credit is achieved either by scheduled payments on the total amount of the debt over time, or by all outstanding loans being repaid on the date of termination.

In a loan, the borrower initially receives or borrows an amount of money, called the "principal," from the lender and is obligated to pay back or repay an equal amount of money to the lender at a later time. Typically, the money is paid back in regular installments, or partial repayments; in an annuity, each installment is the same amount. The loan is generally provided at a cost, referred to as interest on the debt, which provides an incentive for the lender to engage in the loan.