Business Cycle Defined

The term business cycle (or economic cycle) refers to economy-wide fluctuations in production or economic activity over several months or years. These fluctuations occur around a long-term growth trend, and they typically involve shifts over time between periods of relatively rapid economic growth (an expansion or boom) and periods of relative stagnation or decline (a contraction or recession).

The Phases and Turning Points of Business Cycles

Business cycles are composed of two phases and two turning points.

Phases

- Expansion: The period of time in which real GDP rises and unemployment declines. It is sometimes called recovery.

- Contraction: The period of time in which real GDP declines and unemployment rises. A recession is six consecutive months of decrease. A "severe recession" is called a depression. There is no official definition of severe (length and depth).

Turning Points

- Peak: A peak occurs when the real GDP reaches its maximum, stops rising, and begins to decline. It is determined after the fact.

- Trough: A trough occurs when the real GDP reaches its minimum, stops declining, and begins to rise. It is determined after the fact.

Business cycles are usually measured by considering the growth rate of real gross domestic product. Despite being termed cycles, these fluctuations in economic activity do not follow a mechanical or predictable periodic pattern.

The Development of the Theory

The first systematic exposition of periodic economic crises, in opposition to the existing theory of economic equilibrium, was the 1819 Nouveaux principes d'économie politique by Jean Charles Léonard de Sismondi. Prior to that point, classical economics had denied the existence of business cycles; blamed them on external factors, notably war; or only studied them in a long-term context.

Sismondi found vindication in the Panic of 1825, which was the first international economic crisis occurring in peacetime. Sismondi and his contemporary Robert Owen, who expressed similar but less systematic thoughts in the 1817 Report to the Committee of the Association for the Relief of the Manufacturing Poor, both identified the cause of economic cycles as overproduction and underconsumption. These believed these problems were caused in particular by wealth inequality, and they advocated government intervention and socialism, respectively, as the solution.

This work did not generate interest among classical economists, although underconsumption theory developed as a heterodox branch in economics until being systematized in Keynesian economics in the 1930s.

Sismondi's theory of periodic crises was developed into a theory of alternating cycles by Charles Dunoyer, and similar theories, showing signs of influence by Sismondi, were developed by Johann Karl Rodbertus.

Periodic crises in capitalism formed the basis of the theory of Karl Marx, who further claimed that these crises were increasing in severity and would lead to a Communist revolution. Marx devoted hundreds of pages of Das Kapital to crises.

Cycles or Fluctuations?

In recent years, economic theory has moved towards the study of economic fluctuation rather than the study of business cycles. However, some economists use the phrase "business cycle" as a convenient shorthand.

For Milton Friedman, the term "business cycle" is a misnomer because of its noncyclical nature. Friedman believed that for the most part, excluding very large supply shocks, business declines are more of a monetary phenomenon.

Rational expectations theory leads to the efficient-market hypothesis, which states that no deterministic cycle can persist, because it would consistently create arbitrage opportunities.

Much economic theory also holds that the economy is usually at or close to equilibrium. These views have led to the formulation of the idea that observed economic fluctuations can be modeled as shocks to a system.

In the tradition of Slutsky, business cycles can be viewed as the result of stochastic shocks that on aggregate form a moving average series. However, the recent research employing spectral analysis has confirmed the presence of business (Juglar) cycles in the world GDP dynamics at an acceptable level of statistical significance.

Long Term Growth

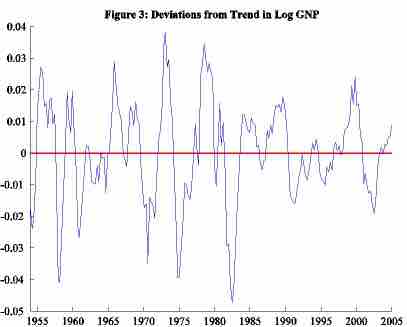

Deviations from the long term growth trend US 1954–2005