Reporting Stockholders' Equity

In financial accounting, owner's equity consists of an entity's net assets. Net assets are the difference between the total assets of the entity, and all its liabilities. Equity appears on the balance sheet of financial position, one of the four primary financial statements. ""

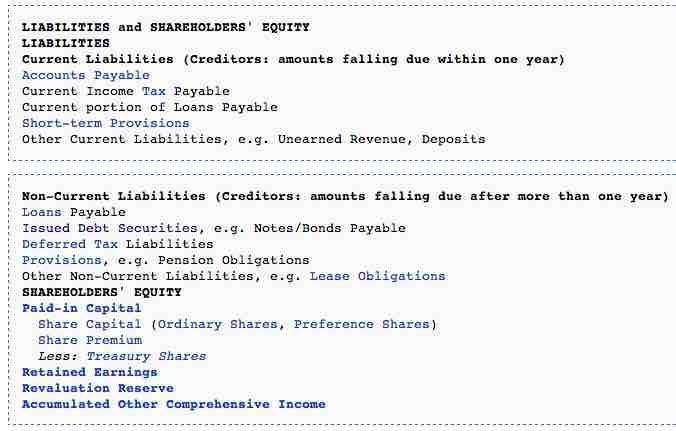

Balance Sheet

Shareholders' equity in a balance sheet.

A statement of shareholder's equity provides investors with information regarding the transactions that affected the stockholder's equity accounts during the period.

The book value of equity will change in the case of the following events:

- Changes in the firm's assets relative to its liabilities. For example, a profitable firm may receive more cash for its products than the cost at which it produced the goods, and so in the act of making a profit, it increases its assets.

- Depreciation. For example, equity will decrease when machinery depreciates. Depreciation is registered as a decline in the value of the asset, and as a decrease in shareholders' equity on the liabilities side of the firm's balance sheet.

- Issue of new equity in which the firm obtains new capital and increases the total shareholders' equity.

- Share repurchases, in which a firm gives back money to its investors, reducing its financial assets, and the liability of shareholders' equity. For practical purposes (except for its tax consequences), share repurchasing is similar to a dividend payment, as both consist of the firm giving money back to investors. Rather than giving money to all shareholders immediately in the form of a dividend payment, a share repurchase reduces the number of shares, thereby increasing the percent of future income and distributions garnered by each remaining share.

The market value of shares in the stock market does not correspond to the equity per share calculated in the accounting statements. Stock valuations, which are often much higher, are based on other considerations related to the business's operating cash flow, profits, and future prospects. Some factors are derived from the accounting statements.

Equity (beginning of year) + net income − dividends +/− gain/loss from changes to the number of shares outstanding = Equity (end of year).

Dirty Surplus Accounting

Dirty surplus accounting involves the inclusion of other comprehensive income or unusual items in net income, which will consequently flow into retained earnings. These items can skew net income and provide information that could be misleading. A prime example of dirty surplus accounting is the inclusion of unrealized gains or losses on treasury stocks, or securities they are holding for sale.

The main problem with dirty surplus accounting is that unusual items that affect shareholders equity can be easily hidden. Employee stock options are a good example of expenses that may not explicitly show up on the income statement. ESOs can, in actuality, cost shareholders a large sum; therefore, it is important for investors to realize the magnitude of these costs in order to correctly value a firm's equity.