The dividend yield or the dividend-price ratio of a share is the company's total annual dividend payments divided by its market capitalization, or the dividend per share, divided by the price per share. It is often expressed as a percentage.

Dividend yield is used to calculate the earning on investment (shares) considering only the returns in the form of total dividends declared by the company during the year. Its reciprocal is the Price/Dividend ratio.

Preferred share dividend yield is the dividend payments on preferred shares, which are set out in the prospectus. The name of the preferred share will typically include its yield at par. For example, a 6% preferred share. However, the dividend may, under some circumstances, be passed or reduced. The yield is the ratio of the annual dividend to the current market price, which will vary.

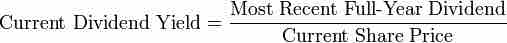

Unlike preferred stock, there is no stipulated dividend for common stock. Instead, dividends paid to holders of common stock are set by management, usually with regard to the company's earnings. There is no guarantee that future dividends will match past dividends or even be paid at all. The historic yield is calculated using the following formula:

Current dividend yield

Current dividend yield = Most recent Full-Year Dividend / Current Share Price

For example, take a company which paid dividends totaling 1 per share last year and whose shares currently sell for $20. Its dividend yield would be calculated as follows: 1/20 = 0.05 = 5%.

The yield for the S&P 500 is reported this way. U.S. newspaper and Web listings of common stocks apply a somewhat different calculation. They report the latest quarterly dividend multiplied by 4 divided by the current price. Others try to estimate the next year's dividend and use it to derive a prospective dividend yield. Such a scheme is used for the calculation of the FTSE UK Dividend+ Index. Estimates of future dividend yields are by definition uncertain.

Historically, a higher dividend yield has been considered to be desirable among many investors. A high dividend yield can be considered to be evidence that a stock is under priced or that the company has fallen on hard times and future dividends will not be as high as previous ones. Similarly, a low dividend yield can be considered evidence that the stock is overpriced or that future dividends might be higher. Some investors may find a higher dividend yield attractive, for instance, as an aid to marketing a fund to retail investors, or maybe because they cannot get their hands on the capital, which may be tied up in a trust arrangement. In contrast, some investors may find a higher dividend yield unattractive, perhaps because it increases their tax bill.