Definition of Convertible Securities

This refers to any security that can be converted into another security. Convertible securities can include bonds that pay interest or preferred stocks that pay dividends. This type of stock has an embedded option that allows it to be converted into a specified number of shares of common stock at a predetermined price; usually at a premium over the stock's market price.

The conversion can also be based on the occurrence of certain conditions, such as the stock's market price appreciating to a predetermined level, or the requirement that the conversion take place by a certain date. The conversion is exercised at the security holder's discretion. The shareholder can also sell the original security and use the conversion feature as a favorable selling point .

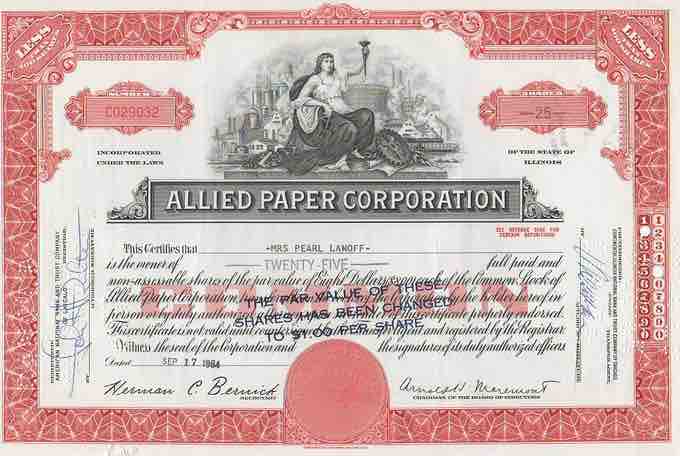

Allied Paper Corp. Common Stock Certificate

A public company's preferred stock is designated as convertible if it can be exchanged for common stock.

Convertible Preferred Stock

Preferred stock (also called preferred shares) is an equity security with properties of both an equity and a debt instrument, and is generally considered a hybrid. Preferred shares rank higher to common stock during earnings distributions, such as dividends; however, they are subordinate to bonds in terms of their claim to company assets in the event of a business liquidation. Unlike common stock, preferred shares usually have no voting rights. The shares may also be cumulative or non-cumulative. A cumulative preferred stock accumulates unpaid prior period dividends into the future, while a non-cumulative preferred loses rights to any dividends not paid in prior periods. The conversion feature adds an option of acquiring common shares, which has certain advantages, such as voting rights.

Convertible Stock and Stockholder's Equity

Accounting principles require the reporting of convertible preferred stock in the same manner as non-convertible preferreds. Preferred stock is reported in the stockholder's equity section as the number of shares outstanding, multiplied by the stock's market price. The result is divided between the value of the shares that fall under "common stock - par value" and the excess value over par is reported as "common stock - additional paid-in-capital". The value of the conversion feature is not reported due to the uncertainty of when the conversion may occur, if at all.