Reporting Assets

One section of the balance sheet consists solely of the business's property, plant, and equipment . To be included in this section of the balance sheet, the asset must last longer than a year, be tangible, be used in business operations, and cannot be held for resale. Common examples of items that would be included are buildings, machinery, and delivery vehicles. Accounting for these types of assets involves following four steps.

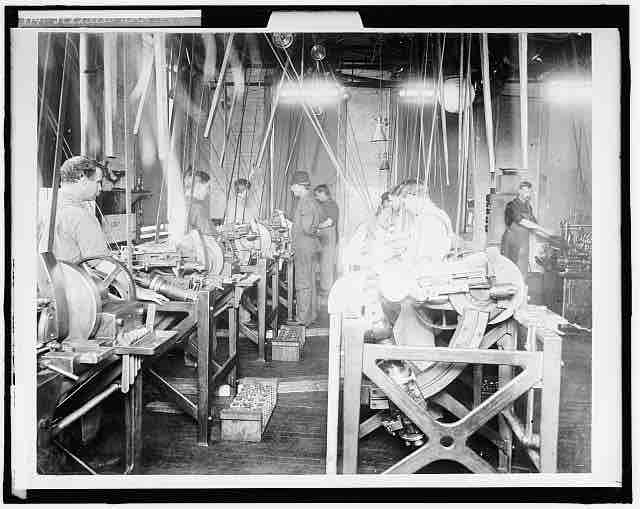

Factory Workers Assembling an Engine

The equipment and plant used to product a business's product must be recorded on its balance sheet.

Record the Acquisition Cost

The acquisition cost is how the asset is valued on a business's balance sheet. The acquisition cost equals the amount of cash and other property given up to acquire it and place it into operation. All expenses that are normal, reasonable, and necessary to obtain and place the property into use are included in the acquisition cost. Costs associated with fixing used property so it can be used by the company are included in the acquisition costs. Unnecessary costs associated with initially transporting the property to where it needs to go is not included in the acquisition cost.

Record Depreciation

The act of using an asset can often cause it to lose value because it physically wears out the property. Or an asset can be inadequate for future needs or become obsolete. In all of these cases, the underlying value of the asset decreases over time. Depreciation is a measure of how property values decrease. Depreciation does not apply to assets that do not lose value over time, such as land.

Depreciation can be calculated different ways for different types of asset. However, there are four things that a business must consider when determining how it will depreciate the asset. The first is the cost of the asset. Next, how much will the company be able to sell the asset for when it is of no longer of use to the company, or its residual value? The value could be based on its scrap value or the fact that the asset may have value to others as is. The company should also determine how long it will be able to use the asset. This period is known as the asset's useful life.

Finally a business must choose a depreciation method. The most common depreciation method type is "straight-line," where the depreciation rate is calculated by subtracting the asset's residual value from its acquisition cost and dividing the result by its useful life.

To insure that the balance sheet reflects the accurate value of its assets, a business will not decrease the value of each asset as it depreciates. Instead, it will record a negative asset balance called accumulated depreciation. By adding the accumulated depreciation with the asset's value, a person reading the balance sheet will be able to determine the asset's current value.

Record Subsequent Expenditures on the Asset

A business can spend money on an asset that will increase its overall value in one of two ways. The first is if the business improves the asset in some way that makes it more valuable. A way an asset may become more valuable is if the business somehow enhances the asset's ability to provide services. For example, if a business installs GPS into one of its trucks so it can make deliveries more efficiently, the expenditure has improved the value of the asset. In that case, the cost of acquiring the improvement is added to the value of the asset account.

A business can also spend money on an asset that does not improve its ability to provide a benefit to the business but extends the asset's useful life. For example, a business may give one of its trucks an overhaul so that it will last another five years instead of another two. In this case, the value of the asset account is not adjusted but its accumulated depreciation account is decreased.

Account for Disposal of Asset

Recording the disposal of an asset requires taking several steps. First, the business must ensure that the asset's depreciation account is up to date. Then the business must write off the asset balance as well as its accumulated depreciation balance. Then it must record any cash or property it received in exchange for the asset. Finally, it must record any gain or loss it sustained on the disposal of the property.