Notes Receivable

Notes Receivable represents claims for which formal instruments of credit are issued as evidence of debt, such as a promissory note. Often a business will allow a customer to convert their overdue accounts into a notes receivable. Doing so gives the debtor more time to pay. Occasionally, the notes receivable will include a personal guarantee by the owner of the debtor.

A notes receivable normally requires the debtor to pay interest and extends for time periods of 30 days or longer. Notes receivable are considered current assets if they are to be paid within 1 year and non-current if they are expected to be paid after one year.

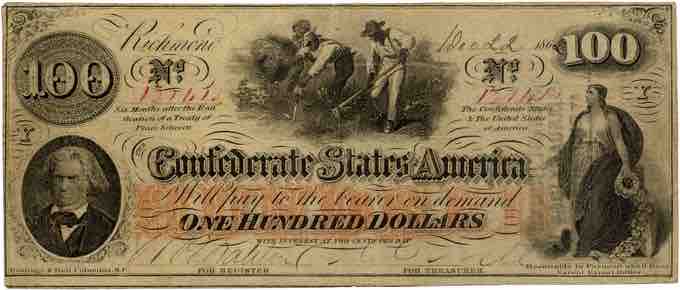

Confederate Note Receivable

A One Hundred Dollar Confederate States of America banknote dated December 22, 1862. Issued during the American Civil War (1861–1865).

Components of a Note Receivable

Principle-the principle is the face value of the note. The principle equals the initial amount of credit provided.

Maker-the maker of a note is the party who receives the credit and promises to pay the note's holder. The maker classifies the note as a note payable.

Payee-the payee is the party that holds the note and receives payment from the maker when the note is due. The payee classifies the note as a note receivable.

Interest-notes generally specify an interest rate, which is used to determine how much interest the maker of the note must pay in addition to the principal.

Calculating interest-interest on short-term notes is calculated according to the following formula:

principle x annual interest rate x time period in years = interest

Example: interest on a four-month, 9%, $1,000 note equals $30