Dividend Payments and Earnings Retention

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. On the other hand, retained earnings refers to the portion of net income which is retained by the corporation rather than distributed to its owners as dividends. Similarly, if the corporation takes a loss, then that loss is retained and called variously retained losses, accumulated losses or accumulated deficit. Retained earnings and losses are cumulative from year to year with losses offsetting earnings. Many corporations retain a portion of their earnings and pay the remainder as a dividend.

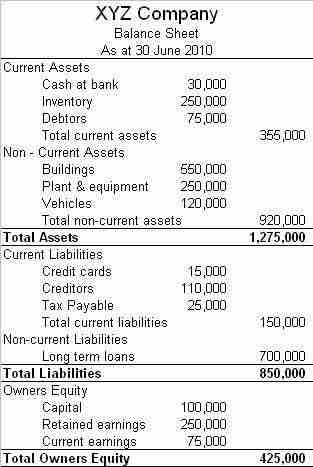

A dividend is allocated as a fixed amount per share. Therefore, a shareholder receives a dividend in proportion to their shareholding. Retained earnings are shown in the shareholder equity section in the company's balance sheet–the same as its issued share capital.

Public companies usually pay dividends on a fixed schedule, but may declare a dividend at any time, sometimes called a "special dividend" to distinguish it from the fixed schedule dividends. Dividends are usually paid in the form of cash, store credits (common among retail consumers' cooperatives), or shares in the company (either newly created shares or existing shares bought in the market). Further, many public companies offer dividend reinvestment plans, which automatically use the cash dividend to purchase additional shares for the shareholder.

Cash dividends (most common) are those paid out in currency, usually via electronic funds transfer or a printed paper check. Such dividends are a form of investment income and are usually taxable to the recipient in the year they are paid. This is the most common method of sharing corporate profits with the shareholders of the company. For each share owned, a declared amount of money is distributed. Thus, if a person owns 100 shares and the cash dividend is $0.50 per share, the holder of the stock will be paid $50. Dividends paid are not classified as an expense but rather a deduction of retained earnings. Dividends paid do not show up on an income statement but do appear on the balance sheet.

Example Balance Sheet

Retained earnings can be found on the balance sheet, under the owners' (or shareholders') equity section.

Stock dividends are those paid out in the form of additional stock shares of the issuing corporation or another corporation (such as its subsidiary corporation). They are usually issued in proportion to shares owned (for example, for every 100 shares of stock owned, a 5% stock dividend will yield five extra shares). If the payment involves the issue of new shares, it is similar to a stock split in that it increases the total number of shares while lowering the price of each share without changing the market capitalization, or total value, of the shares held.

Dividend Payout and Retention Ratios

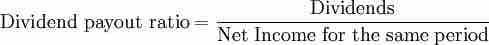

Dividend payout ratio is the fraction of net income a firm pays to its stockholders in dividends:

The part of the earnings not paid to investors is left for investment to provide for future earnings growth. These retained earnings can be expressed in the retention ratio. Retention ratio can be found by subtracting the dividend payout ratio from one, or by dividing retained earnings by net income.

Dividend Payout Ratio

The dividend payout ratio is equal to dividend payments divided by net income for the same period.