Disinflation is a decrease in the rate of inflation–a slowdown in the rate of increase of the general price level of goods and services in a nation's gross domestic product over time. Disinflation occurs when the increase in the "consumer price level" slows down from the previous period when the prices were rising. Disinflation is the reduction in the general price level in the economy but for a very short period of time. Disinflation takes place only when an economy is suffering from recession.

Disinflation

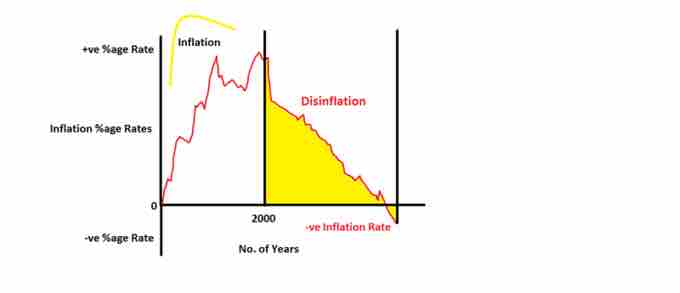

Disinflation is a decrease in the rate of inflation as illustrated in the yellow region of this graph.

If the inflation rate is not very high to start with, disinflation can lead to deflation–decreases in the general price level of goods and services. For example if the annual inflation rate for the month of January is 5% and it is 4% in the month of February, the prices disinflated by 1% but are still increasing at a 4% annual rate. Again, if the current rate is 1% and it is -2% for the following month, prices disinflated by 3% (i.e., 1%-[-2]%) and are decreasing at a 2% annual rate.

The causes of disinflation are either a decrease in the growth rate of the money supply, or a business cycle contraction (recession). If the central bank of a country enacts tighter monetary policy, (i.e., the government start selling its securities) this reduces the supply of money in an economy. This contraction of the monetary policy is known as a "quantitative tightening technique. " When the government sell its securities in the market, the supply of money reduces, and money becomes more upscale and the demand for money remains constant. During a recession, competition among businesses for customers becomes more intense, and so retailers are no longer able to pass on higher prices to their customers. The main reason is that when the central bank adopts contractionary monetary policy, its becomes expensive to annex money, which leads to the fall in the demand for goods and services in the economy. Even though the demand for commodities fall, the supply of commodities still remains unaltered. Thus the prices fall over a period of time leading to disinflation.

When the growth rate of unemployment is below the natural rate of growth, this leads to an increase in the rate of inflation; whereas, when the growth rate of unemployment is above the natural rate of growth it leads to a decrease in the rate of inflation also known as disinflation. This happens when people are jobless, and they have a very small portion of money to spend, which indirectly implies reduction in the supply of money in an economy.