Workplace Basics

Understanding Your Pay, Benefits, and Paycheck

Understanding your pay, benefits, and paycheck

With any job, it can be difficult to decipher everything on your paycheck and figure out what various benefits provide for you. You might be wondering why money is being taken out of your pay and what exactly it's going toward. If some of this is hard for you to understand, that's completely normal! We'll go over all of this and more in this lesson.

Watch the video below to learn about the basic parts of a paycheck.

It's important to note that this lesson is focused primarily on paychecks in the United States. Not all of this information may be applicable or true for you if you live in another country.

Payment options

Businesses usually offer a few payment methods for obtaining your paycheck. The first is simply receiving a physical

paper check

. Just like any other check, it can be

cashed

or

deposited to your bank account

if you have one.

The other option that's also used by many employers is

direct deposit

. This allows your employer to

electronically transfer your paycheck directly to your bank account

. In order to do this, you'll need to provide your employer with a voided check from your bank account or your routing and account numbers.

What's on your pay stub?

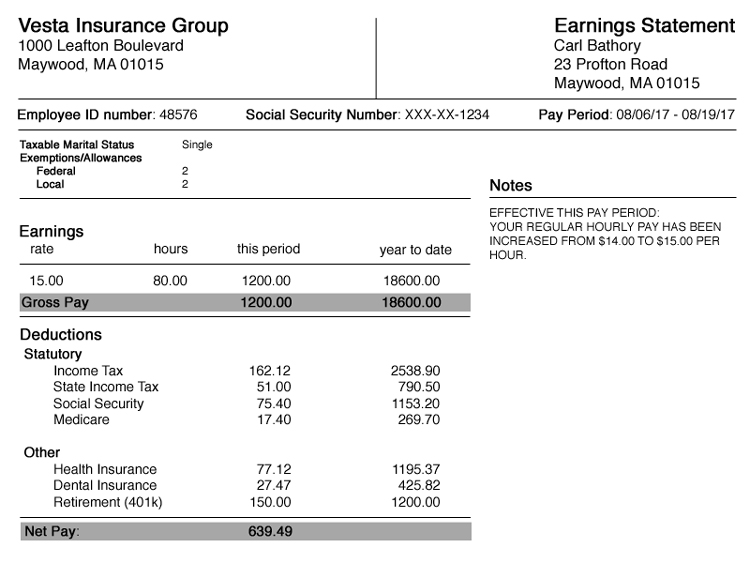

Every paycheck you receive should come with an accompanying pay stub . This is a record of how much you earned from a certain pay period, as well as the amount of money that was removed for deductions . It has quite a bit of information on it, so let's take a look and see what it all means. Your pay stub may look different from the example below, but it should contain most of the same information.

Click the buttons in the interactive below to learn more about the different parts of a pay stub.

Earnings vs. net pay

When you view your pay stub, you'll find two notable figures: your earnings (or gross pay) and your net pay . Your earnings is the amount of money you make based on your pay rate . After a number of taxes and deductions are applied, you're left with your net pay , or the money that's available to you on your paycheck .

Upon your initial payment, you might be surprised at the difference between your earnings and your net pay due to unforeseen deductions. It's important to plan for this difference, especially when budgeting or doing any financial planning.

Taxes

As mentioned above, there are several deductions that may be applied to your earnings. Some of these vary depending on location and your employer, but there's one deduction everyone must deal with:

income tax

.

No matter where you live in the country,

federal income tax

will be deducted from your earnings. The amount of money that's withheld will depend on several factors, including how much you earn and the number of allowances you claimed on your W-4. Depending on where you live, you may also have

state income taxes

deducted from your paycheck.

In addition to income tax, there are

Federal Insurance Contributions Act (FICA) taxes

that are withheld to help fund Social Security and Medicare. For more information on FICA taxes, read

this article

from The Balance.

Benefits

If your workplace offers certain benefits , it may require deductions from your earnings as well. These include things like health insurance , disability , life insurance , and retirement . Below are explanations of these various benefits:

- Health/dental/vision insurance : Health insurance helps to cover some of the high costs of health care. Most employers will pay for a portion of this and require you to pay a portion as well.

- Retirement/pension plan : Retirement plans, such as a 401(k) or 403(b), allow you to save for your retirement. You often choose how much you'd like to contribute, which will then be deducted from your check before taxes are taken out.

- Life insurance : In the event of death, life insurance will provide your beneficiary, usually a family member, with money. Your employer may pay a minimum amount of coverage for this, but you have the option of contributing more from your paycheck.

- Disability insurance : If you experience illness or become disabled, this insurance will provide you with income you would have otherwise lost. Some employers provide minimum coverage, like worker's compensation, but disability insurance varies from state to state.

The information in this article can vary depending on your job, your income, and a number of other factors. If you have any questions about your paycheck or the contents of your pay stub, feel free to ask your employer for clarification.