Online Money Tips

Save Money with Free Budgeting Apps

Save money with free budgeting apps

People often think of starting a new budget as something you do when you're saving for a specific goal or making a New Year's resolution. But the truth is you can start taking charge of your spending anytime!

There are many ways to create a budget, but if you're new to the whole thing you might consider using a

budgeting app

. These apps can do a lot of the math and expense tracking for you, which leaves you with more time and energy to focus on actually saving money. We're going to take a look at a few of the most popular budgeting apps.

Mint

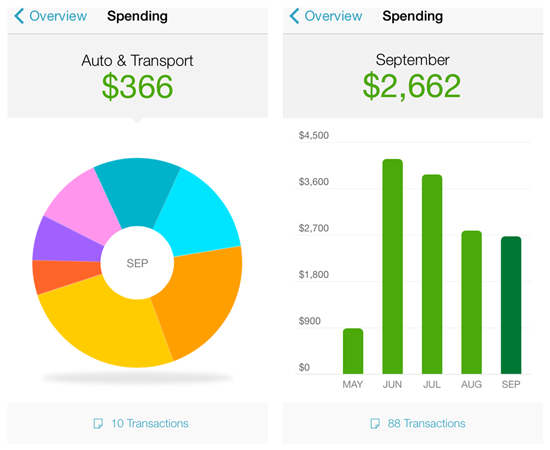

Mint is one of the most comprehensive free budgeting tools out there. After you've given it permission to look at your bank transactions, Mint automatically sorts your expenses into categories like groceries , restaurants , and bills . This helps you understand exactly what you're spending money on, which should also make it easier to decide which expenses to cut. Once you've decided how much you want to spend, you can set a detailed budget with limits on each spending category.

Mint does an excellent job of visualizing your data. It automatically creates beautiful charts and graphs that let you see your spending habits and history at a glance. Mint also does a really good job of sending alerts when something's wrong, like if you've overspent or if your bank has charged you a fee.

That said, Mint has a few drawbacks. First, it has so many features that you might find it overwhelming . Second, while Mint is supposed to automatically categorize your spending expenses it doesn't always get all of them right. Because Mint relies on these categories to track your spending, you'll need to do this part manually from time to time.

These faults are minor, though. If you're looking for a budgeting tool that will give you a

fine-grained look at your spending habits

, Mint is a great choice, especially if you're willing to put in some time to set it up correctly.

Other budgeting apps

There are many other budgeting apps to choose from. Each one has a different set of features, and depending on your needs you may prefer one that has more features or a simplified interface. Although some budgeting apps are free, others require a monthly subscription. Below are a few free apps

- Clarity Money : This app brings many different widgets into a single feed that you can scroll through. It includes automatic saving, allowing you to earmark your savings for specific purposes. This can make it easier to save up for a large purchase like a vacation or a car. It also allows you to cancel various subscriptions (such as Netflix) from within the app if you decide that they don't fit within your budget.

- Empower : This app allows you to connect checking, savings, and other financial accounts so you can see all of your accounts and bills. Like Mint, it can send you alerts if something is wrong (for example, if a bill is higher than usual). It also has an automatic saving feature that can set aside money at specific intervals.

- PocketGuard : If you prefer a simpler budgeting app, you may want to try PocketGuard. This app focuses on showing you how much spending money you currently have. Although it may not have as many features as some apps, the simplified interface may be ideal for many users.

Which app should you use?

Remember, there's no "best" budget app—

you should choose the one that works best for you

. If you have a fairly complex financial situation, Mint might be the best choice. If you are just getting started with saving, PocketGuard's simple focus can help you change your habits quickly. You may even want to try more than one app to see which one is the best fit for you.